Its been nearly couple of years since I was involved with EE/BT for their Airmasts project. Details here with some good links in that post too. Since then many other operators have been involved with something or other to do with drones, blimps, balloons, etc.

Here are a few recent ones that I found interesting

KT has unveiled its 5G emergency network service called Skyship that uses airship drones to search for survivors in the aftermath of disasters.

KT collaborated with local drone maker Metismake to design the helium gas-based airship, which has an attached pod with propellant, network module, high-resolution camera, and a trunk that can deploy smaller drones to the ground.

It was designed in NACA airfoil and can maintain stable flight in 13 metre-per-second winds. It has a maximum speed of 80 kilometers per hour and can fly up to six hours.

More details on ZDNet here.

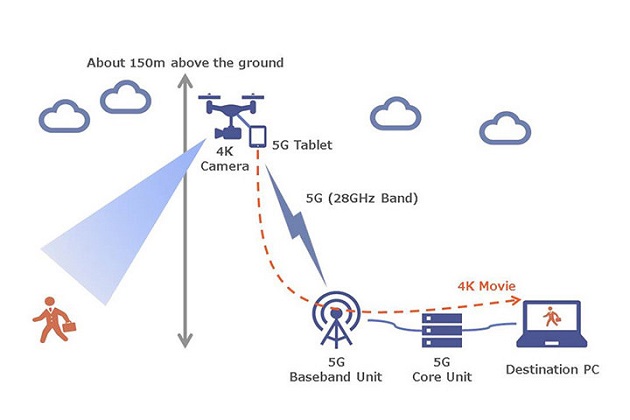

KDDI announced today that it has successfully completed a live 4K video transmission test using a drone that leverages 5G technology. The test was carried out in an effort to realize consumer services that can benefit hugely from drones, such as public safety and surveillance, agriculture monitoring and disaster response. The test, the first of its kind to have taken place in Japan, was carried out in cooperation with Nakao Research Laboratory of the University of Tokyo, TripodWorks and Prodrone.

The test area was set up in the university's Kashiwa campus using Samsung Electronics' 5G end-to-end solutions including 5G AU, 5G core and 5G tablet, and for video streaming 28GHz frequency were used. Using a 5G supporting device, the video shot in the air using the 4K camera mounted on the drone was uploaded in real time.

More details on Netmanias here.

Looking at Drone communications over LTE / 5G, Sequans communications have recently published a white paper looking at how LTE would be a communication technology of choice for drone communications over long distances. There are some issues to resolve including how to get reliable signal in the drones as they fly above the typical coverage zone of an LTE antenna.

Details here: http://lteanddrones.com/

Ericsson had done some similar study and published a whitepaper on this topic last year. Details available here but the video below is worth a watch too.

Here are a few recent ones that I found interesting

KT has unveiled its 5G emergency network service called Skyship that uses airship drones to search for survivors in the aftermath of disasters.

KT collaborated with local drone maker Metismake to design the helium gas-based airship, which has an attached pod with propellant, network module, high-resolution camera, and a trunk that can deploy smaller drones to the ground.

It was designed in NACA airfoil and can maintain stable flight in 13 metre-per-second winds. It has a maximum speed of 80 kilometers per hour and can fly up to six hours.

More details on ZDNet here.

KDDI announced today that it has successfully completed a live 4K video transmission test using a drone that leverages 5G technology. The test was carried out in an effort to realize consumer services that can benefit hugely from drones, such as public safety and surveillance, agriculture monitoring and disaster response. The test, the first of its kind to have taken place in Japan, was carried out in cooperation with Nakao Research Laboratory of the University of Tokyo, TripodWorks and Prodrone.

The test area was set up in the university's Kashiwa campus using Samsung Electronics' 5G end-to-end solutions including 5G AU, 5G core and 5G tablet, and for video streaming 28GHz frequency were used. Using a 5G supporting device, the video shot in the air using the 4K camera mounted on the drone was uploaded in real time.

Looking at Drone communications over LTE / 5G, Sequans communications have recently published a white paper looking at how LTE would be a communication technology of choice for drone communications over long distances. There are some issues to resolve including how to get reliable signal in the drones as they fly above the typical coverage zone of an LTE antenna.

Details here: http://lteanddrones.com/

Ericsson had done some similar study and published a whitepaper on this topic last year. Details available here but the video below is worth a watch too.